Economic Impact Payments on their way

To: All My Clients and Associates: We want to wish you a Happy New Year 2021. We want to start this year on a positive note with information related to [...]

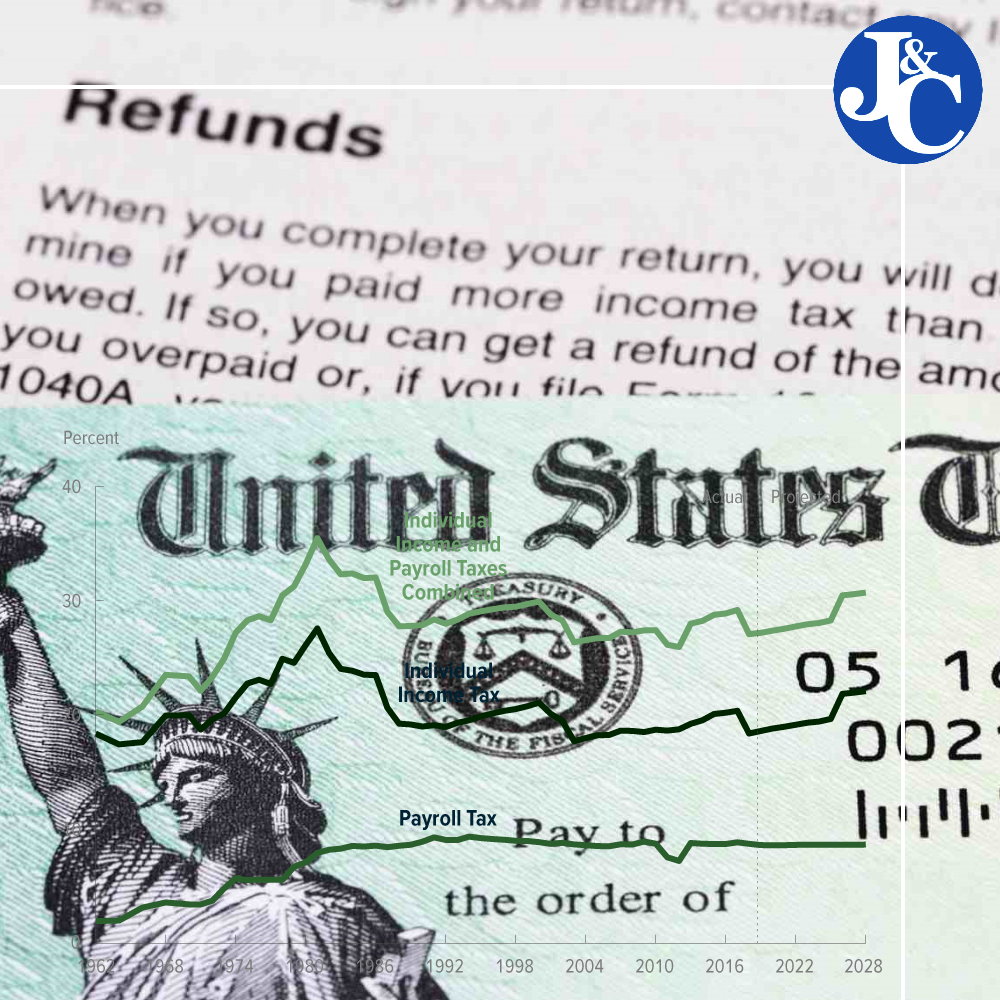

13.9 Million Americans Will Receive IRS Tax Refund Interest This Week

I want to inform you that this week the Treasury Department and the Internal Revenue Service will send interest payments to about 13.9 million individual taxpayers who timely filed their [...]

What You Should Do if You Get a Letter or Notice from the IRS

In our Accounting practice, we received many letters and notices from the Internal Revenue Service, and clients get anxious in these situations. My job is to revise and provide guidance [...]

Do You Need Funds from your Retirement Plan? There is a New Law you Should Know about.

I want to inform you that the CARES Act (Coronavirus Aid, Relief, and Economic Security) can help you if you need additional funds for your business. The CARES Act provides favorable tax treatment [...]

What You Need to Know About the HEALS Act Proposals

This week I want to inform all my clients about the Heals Act by the Majority Leader Mitch McConnell last Monday. These collections of stimulus measures aim to help American [...]

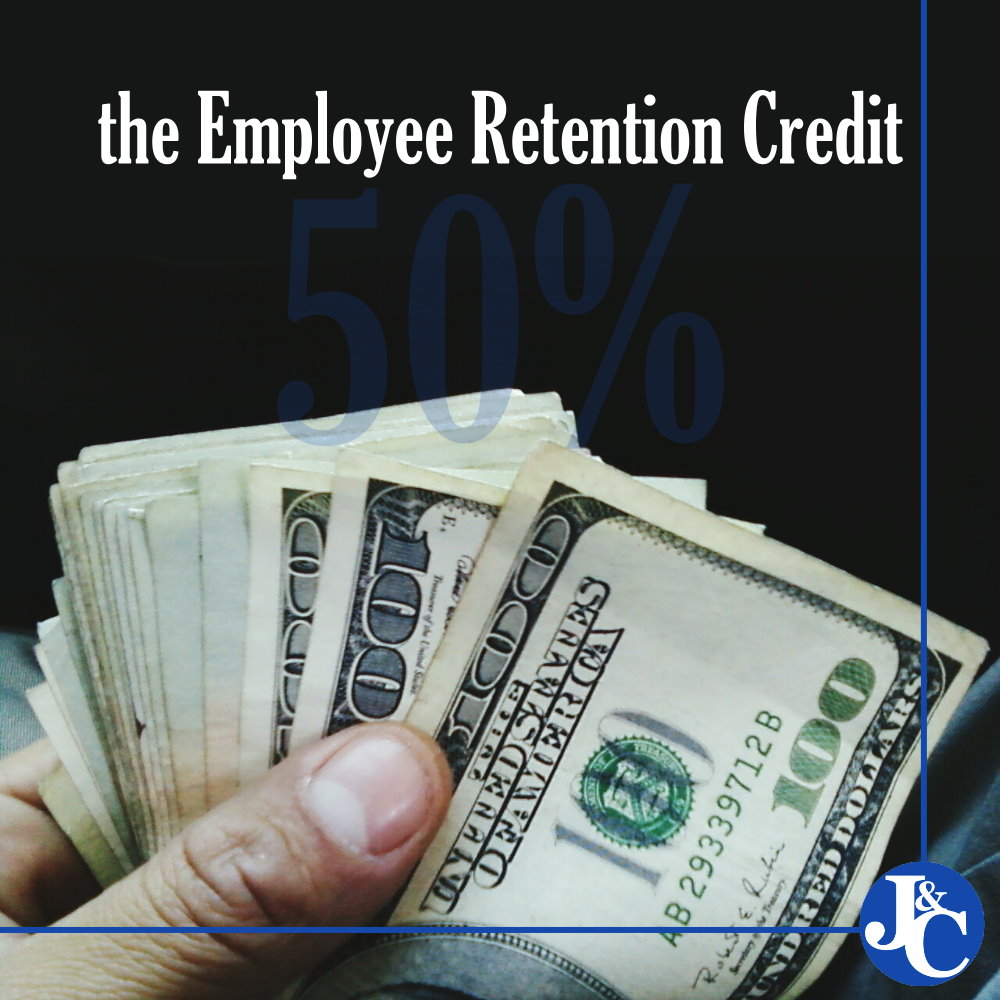

What Employers Need to Know About the Employee Retention Credit

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 percent of the qualified wages an eligible employer pays to employees after March 12, [...]

How You Can Quickly and Easily Check Your Tax Refund Status

This week we worked on finalizing tax returns, and one of the most frequent questions I received was related to how to track the status of the tax refunds. As [...]

What Employers Need to Know About The Families First Coronavirus Response Act

This week we received notifications from clients that a couple of employees have been directly affected by the COVID-19. Our clients' concerns were firstly about their health and then how [...]

The SBA Reopened EIDL Applications Portal

On June 15, the SBA announced that it was again opening its Economic Injury Disaster Loan (EIDL) grant and loan programs. This means that independent subcontractors, freelancers, and gig workers are eligible [...]

PPP Forgiveness: 8 Weeks vs. 24 Weeks?

The Paycheck Protection Program Flexibility Act made significant changes to the PPP loans. One of the biggest changes was to the eight-week forgiveness period. If you were assigned a PPP [...]

An Extension To File Is Not An Extension To Pay Taxes

Last week our office has been working on sending tax extensions for corporations and individuals. As I wrote last week the new tax deadline is July 15. However, I received [...]

Filing and Payment Deadline Extended to July 15, 2020

Our office this week resumes in full the preparation and filing of Income Tax Returns for clients. I have been advising clients about the new tax deadlines and how these [...]