A Tax Break for Christmas

This week I have great news for all my clients and subscribers waiting for congress to extend some key tax provisions. Congress gave us an earlier gift by approving permanent [...]

Should I take the Standard Deduction or Itemize?

This week I will cover a tax topic that I was asked while I was working in a tax planning for one of my clients. My client asked me what was [...]

Tax Tips for Deducting Gifts to Charities

After the celebration of Thanksgiving with our families we realize that year-end is around the corner now. This is the time to revise and make your final tax moves for [...]

How a 401k Plan Works? The Basics and Tax Advantages

I am working this week in revising retirement plans contributions for some of my clients participating in 401K plans. I am sharing with you this week the basics and the [...]

Three Tax Considerations during Marketplace Open Enrollment

We are sad to learn about the tragic events that took place in Paris last Friday. Our thoughts and prayers are with the friends in the City of Love and Lights. [...]

Stay alert from scam phone calls

Last week a client called me to let me know that he received a phone call from the Internal Revenue Service demanding to pay $2,000 over the phone. Being a client of [...]

How to take advantage of Education Tax Credits

This week I want to write on how to take advantage of Education tax credits if you, your spouse or any of your dependents is attending college or any eligible education institution. [...]

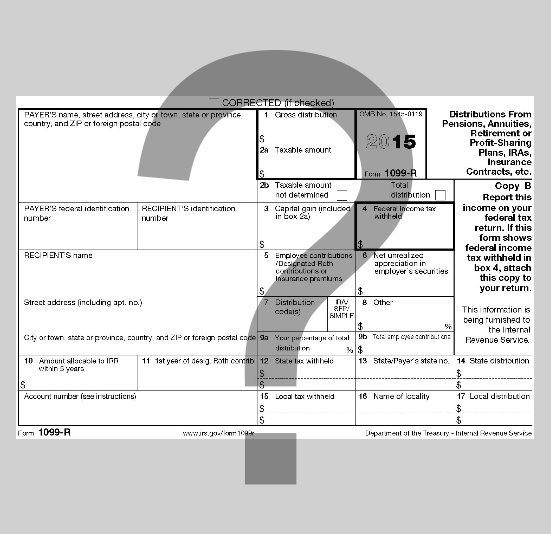

IRS IS ENFORCING 1099 FORMS PENALTIES

I would like to share an experience I had with two clients last week. These two taxpayers received IRS penalties related to late filings of forms 1099. After I revised the filing dates [...]

Blog Renew Postings

This is to let you know that I will resume my weekly posting starting next week. Please let me know what subjects you will be interested to read. I will [...]